Rating Financial Services -The New Rating Formula 5.0

"Ensuring the safety of trading funds while minimizing transaction costs and gaining access to cutting-edge technology."

Web 3.0 and the Evolution of Financial Ratings

In the era of Web 3.0 and machine learning, financial ratings will not be the same. Users will increasingly define their own criteria to receive tailored ratings for the financial services they seek. In the future, they may not even need to do so manually. Smart systems will generate user profiles and deliver personalized ratings automatically, based on browsing history and behavioral data.

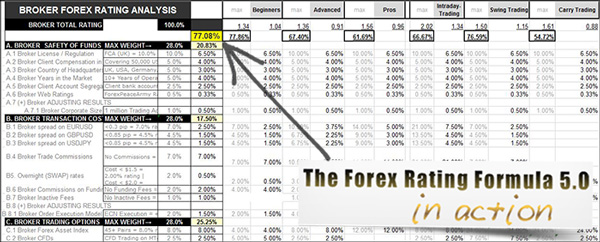

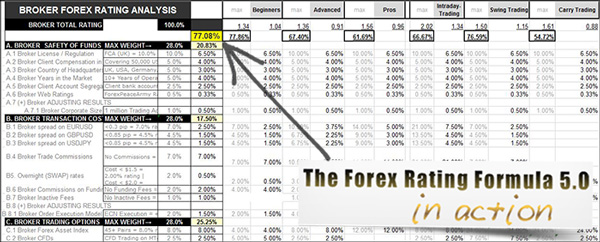

Introducing the Forex Rating Formula v5.0 – The Industry’s Most Advanced Evaluation Tool

The Rating Formula Series, created by financial analyst Giorgos Protonotarios, is designed to revolutionize how financial brokers are rated.

The Problem of Manipulated Online Ratings

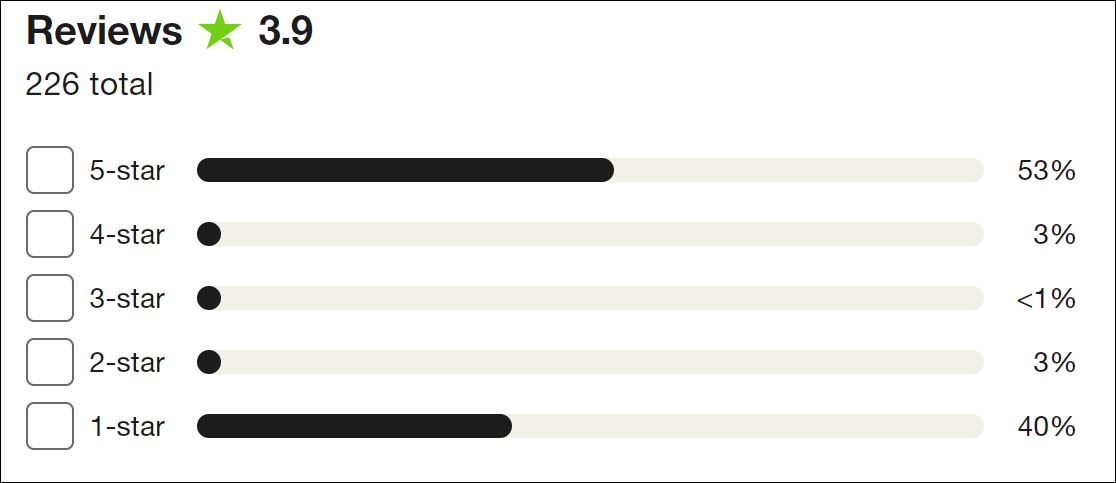

When encountering a new financial firm, it’s common practice to search for its rating online. However, studies show that over 50% of online user reviews and ratings are fake. Many corporations pay third parties to write favorable reviews for themselves and unfavorable ones for their competitors. A strong indicator of this manipulation is the prevalence of extreme scores (e.g., 10/10 or 1/10).

On the following example, a major financial firm was shown to have 93% of its 226 reviews rated either 5/5 or 1/5 -that clearly indicates manipulated data.

Solution: An Objective, Transparent Rating Framework

The Rating Formula offers a consistent, trustworthy, and objective system for evaluating any brokerage firm. It is built on a 4-factor model, covering key aspects of trading:

-

Safety of Funds

-

Cost of Trading

-

Trading Options

-

Technological Efficiency

At its core is a simple mission:

“Ensuring the safety of trading funds while minimizing transaction costs and gaining access to state-of-the-art technology.”

THE RATING FORMULA 5.0 -STRUCTURE OVERVIEW

The formula incorporates four rating factors, each with sub-factors and specific weightings. The maximum total score is always 100%.

Weight Breakdown:

-

A. Safety of Funds – 28%

-

B. Cost of Trading – 28%

-

C. Variety of Trading Options – 28%

-

D. Technological Efficiency – 16%

FACTOR-A: Safety of Funds, Weight 28.0%

Overview

Modern financial firms often take on excessive risk, incentivized by bonuses tied to performance, not risk management. This has historically led to major crises, such as the 2007–2008 meltdown.

This factor evaluates a firm's ability to protect client funds, incorporating both regulatory strength and operational integrity.

What’s New in v5.0:

-

Safety of Funds increased to 28% (from 26%)

-

New sub-factor: Client Compensation in Case of Insolvency (5%)

|

A. FUNDS SAFETY |

MAX WEIGHT |

28.0% |

|

A.1 Regulation |

Regulators:

Addition:

|

10.0% |

|

A.2 Client Compensation in Case of Insolvency |

|

5.0% |

|

A.3 Headquarters |

|

5.0% |

|

A.4 Years of Operation |

|

5.0% |

|

A.5 Client Bank Account Segregation |

|

2.5% |

|

A.6 Web Ratings (Used for differentiating rating results) |

|

0.5% |

|

A.7 (+) ADJUSTMENTS |

(+) |

|

|

A.7.1 Company Size Factor |

|

+1.00% |

Factor-A assesses the overall reliability and security of a Forex broker by evaluating several key sub-factors. Each sub-factor reflects the broker’s ability to operate within a safe and regulated environment, thereby protecting client funds and ensuring long-term viability.

A.1 Regulation *(Weight: 10.00%)

□ Calculation Method: Accumulation*

Strong regulatory oversight significantly reduces the risk of broker misconduct. A trustworthy regulatory authority can impose heavy penalties, enforce compliance, and revoke licenses when necessary. Therefore, the presence of strict regulation benefits all types of traders. Each version of the Rating Formula takes into account the latest regulatory updates.

Example: In the past 12 months, CySEC (Cyprus Securities and Exchange Commission) revoked licenses from several non-compliant brokers and introduced stricter limitations on credit bonuses to enhance trader protection. These regulatory actions increased CySEC’s score within Rating Formula 5.0.

A.2 Client Compensation in Case of Insolvency *(Weight: 5.00%)

□ Calculation Method: Selection*

Even the most reputable brokers are exposed to risks such as business failure, liquidity crises, or market disruptions. A robust client compensation scheme is crucial for safeguarding trader funds in case of broker insolvency. Below are key compensation scheme benchmarks by the regulator:

- FCA (UK) – FSCS covers up to £50,000

- ICF (Cyprus) – Covers up to €20,000

- BaFIN (Germany) – Up to €20,000 for investments and €100,000 for cash

- FINMA (Switzerland) – Coverage up to CHF 100,000

- HCMC (Greece) – Up to €30,000

- MFSA (Malta) – Up to €20,000

- CBI (Ireland) – Up to €20,000

- ASIC (Australia) – No compensation scheme

- FSC (BVI) – No compensation scheme

A.3 Headquarters Location *(Weight: 5.00%)

□ Calculation Method: Selection*

The country of a broker’s corporate headquarters greatly impacts its legal and financial accountability. Brokers based in jurisdictions with strict corporate and financial regulations receive higher ratings. Offshore brokers receive no points in this category due to lower regulatory transparency.

A.4 Years of Operation *(Weight: 5.00%)

□ Calculation Method: Selection*

A broker’s longevity is an important indicator of business stability and operational reliability. Historically, fraudulent brokers tend to disappear within two years.

- Brokers with less than 2 years of operation receive zero points

- Brokers with more than 10 years in operation receive full points

A.5 Segregated Client Bank Accounts *(Weight: 2.50%)

□ Calculation Method: Selection*

Segregated accounts ensure that client funds are kept separate from the broker’s operational funds. This practice promotes transparency and adds a layer of protection in case the broker faces financial difficulties.

A.6 Web Ratings *(Weight: 0.50%)

□ Calculation Method: Accumulation*

This sub-factor integrates external trust scores from reliable sources such as ForexPeaceArmy to add an independent view of a broker’s reputation. Though minor in weight, this element helps fine-tune overall scores.

A.7 Adjustments: Broker-Specific Strengths

Adjustments account for exceptional broker characteristics. In Factor-A, one such adjustment is:

A.7.1 Broker’s Size *(Weight: up to +1.00%)

□ Calculation Method: Adjustment*

Brokers with a large client base demonstrate proven capacity to scale operations and earn client trust. Accordingly, size-based bonus ratings are applied:

- Over 1 million trading accounts = +1.00%

- Over 500,000 accounts = +0.50%

- Over 250,000 accounts = +0.25%

FACTOR B: COST OF TRADING – 28%

Overview

Trading costs are a major concern. Factor-B evaluates spreads, commissions, overnight rates, and hidden fees.

What’s New in v5.0:

- EURUSD weight reduced to 7% (from 8%) due to shrinking market share

- New sub-factor: Overnight (Rollover) Rates

- Inactive fees weight reduced to 1%

|

B. TRANSACTION COST |

MAX WEIGHT |

28.0% |

|

B.1 EURUSD Spread |

(+) Smart Filter: Check Below |

7.0% |

|

B.2 GBPUSD Spread |

|

4.5% |

|

B.3 USDJPY Spread |

|

4.5% |

|

B.4 Trading Commissions Charged (per round traded lot) |

(+) Smart Filter: Check Below |

7.0% |

|

B.5 Overnight (Rollover) Rates |

Based on the total overnight cost of a round EURUSD trade (worth 1 lot on each side):

|

2.0% |

|

B.6 Withdrawal Commissions |

|

2.0% |

|

B.7 Maintenance / Inactive Fees |

|

1.0% |

|

B.8 (+) ADJUSTMENTS |

(+) |

|

|

B.8.1 Execution Model |

|

+2.00% |

Factor-B evaluates the overall cost structure imposed by a Forex broker. This includes spreads, commissions, overnight charges, funding fees, and more. Since trading costs directly affect a trader’s profitability, this factor carries significant weight in the overall broker rating system.

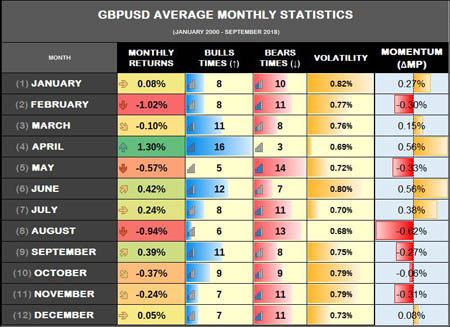

B.1, B.2, B.3 – Spread on Key Currency Pairs *(EUR/USD, GBP/USD, USD/JPY – Combined Weight: 16.00%)

□ Calculation Method: Selection*

These three currency pairs are the most actively traded in the global Forex market. Nearly all traders engage with at least one of them regularly. The spreads charged on these pairs serve as a reliable benchmark for assessing the broker's general pricing model. A broker that charges wide spreads on these pairs is likely to apply similarly high spreads across all instruments.

(+) Smart Filter:

If the spread on EUR/USD exceeds 4.0 pips, the broker receives a zero (0) rating for B.4 (Trading Commissions). This penalty reflects the fact that excessively high spreads negate the benefit of commission-free trading.

B.4 – Trading Commissions per Full (Round) Lot *(Weight: 7.00%)

□ Calculation Method: Selection*

This sub-factor evaluates the direct trading commissions charged by brokers, calculated on a full (round-trip) lot basis. Brokers offering lower commissions receive higher ratings, as lower trading costs improve trader profitability.

(+) Smart Filter:

If commissions exceed $25 per full lot, then the ratings for B.1, B.2, and B.3 (Spreads) are automatically set to zero (0). This is because extreme commissions effectively cancel out the benefit of low or even zero spreads.

B.5 – Overnight (Rollover) Charges *(Weight: 2.00%)

□ Calculation Method: Custom Calculation*

Overnight charges, also known as swap or rollover fees, apply when a position is held overnight. These fees reflect the interest rate differential between the currencies in a trading pair and may be either positive or negative, depending on the trade direction (long or short).

To evaluate this cost, the Rating Formula uses two simulated overnight trades on EUR/USD:

- A long position of $100,000

- A short position of $100,000

The broker’s score is determined by the absolute total cost (in USD) of maintaining both positions overnight:

Total Overnight Cost = |(Long Swap) + (Short Swap)|

Lower combined overnight costs result in better ratings. This measure is especially relevant for swing and carry traders.

B.6 – Funding Fees / Deposit & Withdrawal Commissions *(Weight: 2.00%)

□ Calculation Method: Selection*

This sub-factor assesses whether a broker charges fees on deposits or withdrawals (excluding third-party payment fees). These costs reduce accessible trading capital and are viewed unfavorably in the Rating Formula. Brokers offering zero-fee funding and withdrawal options receive the highest scores.

B.7 – Account Maintenance / Inactivity Fees *(Weight: 1.00%)

□ Calculation Method: Selection*

Some brokers impose inactivity fees on accounts with no trading activity for a defined period (typically after 90 days). These fees are considered unfavorable, particularly for part-time or seasonal traders. Brokers that do not charge inactivity fees receive full points in this category.

B.8 – Adjustments

To account for differences in execution quality, a specific adjustment is included in Factor-B.

B.8.1 Execution Model *(Weight: up to +2.00%)

□ Calculation Method: Adjustment*

A broker’s execution model significantly influences both trading costs and order execution speed. ECN/STP (No Dealing Desk or NDD) models are typically preferred over Dealing Desk (DD) models because they offer greater transparency, better pricing, and faster execution.

Adjustment Weights:

- ECN/STP/NDD execution = +2.00%

- The hybrid model = partial adjustment

- Dealing Desk only = no adjustment

FACTOR C: TRADING OPTIONS – 28%

Overview

Diverse trading instruments and flexible features improve trader adaptability and strategy.

What’s New in v5.0:

- Increased weight to 28% (from 26%)

- Added: Futures/CFDs on Futures, Minimum Stop-Order Levels

- Leverage rating reduced to 1%

- Bonus rating modified – Cash bonus = 100% weight, Credit = 50%, Margin-unusable credit = 0%

|

C. TRADING OPTIONS AVAILABLE |

MAX WEIGHT |

28.0% |

|

C.1 Forex Index |

|

8.0% |

|

C.2 CFD Assets |

|

2.5% |

|

C.3 Futures Contracts (swap-free) |

Futures Contracts or CFDs on Futures:

|

1.5% |

|

C.4 Demo/Practice Account |

|

2.0% |

|

C.5 Capital Leverage |

|

1.0% |

|

C.6 Promotions |

{C.6.1 + C.6.2 | max = 5.0%} |

5.0% |

|

C.6.1 Welcome Bonus (%) |

Notes: (i) Cash (withdrawable) bonus receives 100% of the total rating points (ii) Credit bonus receives 50% of the total rating points (ii) Credit Bonus that can’t be used as margin on negative account balance receives 0% rating |

Added above |

|

C.6.2 Trading Rebate (%) |

Trading rebates as a percentage of the total trading cost (spreads + commissions):

|

Added above |

|

C.7 Minimum Account Deposit |

|

2.0% |

|

C.8 Deposit Methods |

max rating = 5 methods |

2.5% |

|

C.9 Withdrawal Methods |

max rating = 5 methods |

2.5% |

|

C.10 Minimum Stop-Order Levels (in pips) |

Minimum stop-order distance requirement:

|

1.0% |

|

C.11 (+) ADJUSTMENTS |

(+) |

|

|

C.11.1 Asset Index with more than 100 Forex Pairs |

|

+1.00% |

|

C.11.2 Interest on Unused Funds |

|

+0.50% |

|

C.11.3 Contests / Championships |

|

+0.25% |

Factor-C evaluates the depth, flexibility, and usability of a broker’s trading environment. It encompasses available instruments, account features, deposit/withdrawal methods, leverage, bonuses, and more. These elements are essential in providing traders with a well-rounded and efficient trading experience.

C.1 – Number of Currency Pairs *(Weight: 8.00%)

□ Calculation Method: Selection*

A broader selection of currency pairs increases trading opportunities and supports a wider range of strategies. Brokers offering a diverse currency index receive higher ratings, as they enable traders to explore more market scenarios, cross pairs, and exotic pairs.

C.2 – CFD Trading Availability *(Weight: 2.50%)

□ Calculation Method: Selection*

The availability of Contract for Difference (CFD) trading expands the trader’s market access. The Rating Formula 5.0 gives preference to CFD trading on MT4 or advanced platforms, rather than limited web-based platforms, due to superior functionality and reliability.

C.3 – Futures Contracts or CFDs on Futures *(Weight: 1.50%)

□ Calculation Method: Selection*

The option to trade Futures or CFDs on Futures is particularly beneficial for swing and position traders. These instruments do not incur overnight charges, making them ideal for holding long-term positions.

C.4 – Demo / Practice Account *(Weight: 2.00%)

□ Calculation Method: Selection*

The availability of a demo account allows traders to test the broker’s platform and services without risk. It’s valuable for both beginners and experienced traders assessing new strategies or conditions. Brokers that provide unlimited or extended demo access receive higher ratings.

C.5 – Capital Leverage Options *(Weight: 1.00%)

□ Calculation Method: Selection*

While leverage enhances strategy flexibility, it also increases risk and transaction costs. For this reason, its weight in the rating is capped at 1.0%. Brokers offering reasonable and adjustable leverage options receive favorable scores.

C.6 – Promotions: Welcome Bonus & Rebates *(Total Weight: 5.00%)

□ Calculation Method: Selection (C.6.1 + C.6.2 combined)*

C.6.1 – Welcome Bonus

Bonuses can enhance available capital. The formula distinguishes between:

-

Cash Bonus: 100% of the rating points

-

Credit Bonus: 50% of the rating points

(Credit bonuses are margin-only and not withdrawable)

Note: If a credit bonus cannot be used as margin (e.g., during a negative balance), the broker receives 0 rating points in this category.

C.6.2 – Trading Rebates

A rebate system provides cashback based on trading volume, effectively lowering transaction costs. The rating score is calculated as a percentage of total trading costs (spreads + commissions).

C.7 – Minimum Deposit Requirement *(Weight: 2.00%)

□ Calculation Method: Selection*

Lower minimum deposit requirements improve accessibility and make it easier for traders to test live conditions with minimal risk. Brokers with lower barriers to entry receive higher scores.

C.8 – Number of Deposit Methods *(Weight: 2.50%)

□ Calculation Method: Accumulation*

Traders benefit from a variety of deposit options, especially if they prefer specific payment systems. More deposit methods contribute to faster funding, reduced friction, and improved user experience.

C.9 – Number of Withdrawal Methods *(Weight: 2.50%)

□ Calculation Method: Accumulation*

While most brokers mirror deposit methods for withdrawals, some limit withdrawal options. This sub-factor rewards brokers that offer diverse, fast, and convenient withdrawal options, enhancing trader flexibility.

C.10 – Minimum Stop-Order Levels *(Weight: 1.00%)

□ Calculation Method: Selection*

The minimum stop-order distance is crucial for scalpers, intraday traders, and news traders. Brokers that allow tight stop distances enable more precise risk management and receive higher ratings in this category.

C.11 – Adjustments

To reflect added value beyond standard offerings, the following adjustments are applied:

C.11.1 – Availability of 100+ Currency Pairs *(Weight: +1.00%)

□ Calculation Method: Adjustment*

Brokers offering 100 or more currency pairs support greater strategy diversity and receive an additional rating boost.

C.11.2 – Interest on Deposited Funds *(Weight: +0.50%)

□ Calculation Method: Adjustment*

Some brokers pay interest on unused account balances. This enhances capital efficiency, especially for low-frequency or long-term traders.

C.11.3 – Trading Contests / Championships *(Weight: +0.25%)

□ Calculation Method: Adjustment*

Contests can serve as free educational tools for beginners and provide risk-free profit opportunities for experienced traders. Brokers that offer trading competitions earn additional points.

FACTOR-D: Technological Efficiency, Weight 16.0%

Technology plays a pivotal role in modern Forex trading. A broker’s technological infrastructure directly impacts execution speed, platform stability, trading flexibility, and the overall user experience. Factor-D evaluates a broker’s performance across several key tech-based criteria.

What’s New in Rating Formula 5.0?

The latest version of the Rating Formula introduces refinements to better reflect the real-world performance and usability of a broker’s technology:

- Factor-D's total weight is capped at 16.0%

- ‘Trading Platforms Availability’ is capped at 3.0% to prevent overweighting standard offerings

- ‘Trading-on-Charts’ functionality is newly introduced, highlighting platforms that allow direct order placement from chart interfaces

- ‘Slippage on Order Execution’ is now included but limited to 1.0% due to challenges in accurate measurement

- Mobile Trading Rating now emphasizes the quality of native iOS and Android apps over generic web mobile platforms

- ‘Free VPS Hosting’ is added as an adjustment factor, recognizing brokers that offer support for automated and latency-sensitive trading strategies

|

D. TECHNOLOGY |

MAX WEIGHT |

16.0% |

|

D.1 Trading Platforms Availability |

max = Three (3) platforms |

3.0% |

|

D2. Trading-on-Charts |

|

1.0% |

|

D.3 Slippage on Order Execution |

Slippage on Order Execution (in pips):

|

1.0% |

|

D.4 Automated Trading and Expert Advisors |

|

2.0% |

|

D.5 MT4 Platform |

|

2.0% |

|

D.6 Mobile Traders |

Max score is 2.0% (*) D.6 will be absolute in the future. |

2.0% |

|

D.7 Allowing Scalping/Hedging |

|

1.0% |

|

D.8 Customer Support |

Max score is 4.0% |

4.0% |

|

D.9 (+) ADJUSTMENTS |

(+) |

|

|

D.9.1 PAMM / MAM Accounts |

|

+0.5% |

|

D.9.2 Free VPS |

|

+0.5% |

|

D.9.3 API Trading |

|

+0.5% |

In today’s fast-paced trading environment, technological efficiency is essential. The tools a broker offers—platforms, features, and infrastructure—directly influence trade execution, strategy flexibility, and the overall user experience. Factor-D evaluates a broker’s commitment to delivering robust, modern, and trader-friendly technology.

D.1 Number of Trading Platforms (Weight: 3.00%)

□ Calculation Method: Accumulation

The broader the variety of available trading platforms, the more flexibility traders have in choosing tools that suit their style—whether it’s desktop, web, or mobile-based environments.

D.2 Trading-on-Charts (Weight: 1.00%)

□ Calculation Method: Selection

Trading directly from charts enhances decision-making speed and convenience. Features like placing pending orders, setting stop-loss or take-profit levels directly from a chart are essential for active traders.

D.3 Slippage on Order Execution (Weight: 1.00%)

□ Calculation Method: Selection

Slippage—the difference between the expected price and the execution price—can significantly increase trading costs. This factor assesses the average slippage a broker applies, especially relevant for scalpers and news traders.

D.4 Automated Trading (Weight: 2.00%)

□ Calculation Method: Selection

Support for automated trading, including Expert Advisors (EAs), is crucial for traders using algorithmic strategies. Brokers must fully accommodate such tools to achieve a high score here.

D.5 MetaTrader Availability (Weight: 2.00%)

□ Calculation Method: Selection

MetaTrader 4 remains the most widely used Forex trading platform due to its powerful tools and vast ecosystem. Brokers offering MT4 or MT5 earn favorable ratings in this sub-factor.

D.6 Mobile Trading (Weight: 2.00%)

□ Calculation Method: Accumulation

Mobile trading is no longer optional. Brokers are rated on the availability and quality of their mobile apps, with emphasis on dedicated iOS and Android platforms.

D.7 Scalping and Hedging Allowed (Weight: 1.00%)

□ Calculation Method: Selection

These trading styles offer greater flexibility. Brokers that permit both scalping and hedging strategies score higher.

D.8 Customer Support (Weight: 4.00%)

□ Calculation Method: Accumulation

Responsive and multi-channel customer support is vital. This factor evaluates support availability (e.g., 24/7, 24/6, or 24/5) and the range of contact methods (email, live chat, phone, Skype, forum, etc.).

D.9 Adjustments

Note: The maximum total weight of Factor-D remains capped at 16.0%.

D.9.1 PAMM / MAM Accounts (Weight: +0.50%)

□ Calculation Method: Adjustment

PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) accounts enable professional fund management. Brokers supporting these services receive an added rating boost.

D.9.2 Free VPS Hosting (Weight: +0.50%)

□ Calculation Method: Adjustment

Virtual Private Servers (VPS) ensure 24/7 uninterrupted trading, especially valuable for EA users. Brokers offering free VPS hosting are rewarded with additional points.

D.9.3 API Trading (Weight: +0.50%)

□ Calculation Method: Adjustment

API trading allows seamless integration between a trader’s system and the broker’s trading infrastructure. It supports advanced, automated, or high-frequency trading strategies and reflects a broker’s technological sophistication.

BROKER RATINGS BASED ON RATING FORMULA 5.0

Table: The first ratings using the Forex Rating Formula 5.0

|

Broker |

Overall Rating |

1. Safety |

2. Competition |

3. Options |

4. Technology |

Full Rating Analysis |

Website |

|

IC MARKETS |

80.6% |

70.9% |

79.5% |

80.4% |

100.0% |

||

|

DUKASCOPY |

81.6% |

99.5% |

78.6% |

65.1% |

84.1% |

||

|

FBS FOREX |

65.8% |

27.0% |

62.5% |

88.4% |

100.0% |

Six (6) Specialized Rating Categories Introduced in Rating Formula 5.0

Rating Formula 5.0 introduces a more dynamic and customizable approach to evaluating Forex brokers. By adjusting the weight of various rating factors, the system can generate tailored rating scores based on specific trader profiles and needs, while maintaining a consistent foundation of reliability and transparency.

Note: Factor-A (Safety of Funds) remains constant at 28.0% across all rating variations. This ensures that the core measure of a broker’s credibility is equally emphasized for all trading styles and experience levels.

(i) Ratings Based on Trading Style

Intraday Traders

Tailored for high-frequency traders who prioritize speed, cost-efficiency, and execution precision.

Key focus areas:

- Execution model

- Spreads & commissions

- Slippage

- Stop-order distances

- Scalping & hedging support

- Trading-on-charts

- API access

- Automated trading (EAs)

Swing Traders

Designed for traders holding positions over several days who require a broader asset selection and competitive rollover conditions.

Key focus areas:

- Forex asset index

- Spreads & commissions

- Overnight (swap) rates

- Platform functionality

Carry Traders

Targeted toward traders who seek to profit from interest rate differentials.

Key focus areas:

- Overnight interest (swap) rates

- Forex asset coverage

- Inactive account fees

(ii) Ratings Based on Trader Experience

Forex Broker Ratings for Beginners

Focuses on accessibility, ease of use, and entry-level resources for new traders.

Key focus areas:

- User-friendly trading conditions

- Demo/practice accounts

- Low minimum deposit

- A variety of deposit methods

- Welcome bonuses or incentives

Forex Broker Ratings for Advanced Traders

Balances cost-efficiency and trading diversity with a strong platform offering.

Key focus areas:

- Execution model

- Spreads & commissions

- Forex & CFD asset indices

- Overnight rates

- Trading rebates

- Platform variety

Forex Broker Ratings for Professional Traders

Caters to experienced traders who require institutional-grade tools and efficiency.

Key focus areas:

- ECN/STP execution

- Tight spreads & low commissions

- Advanced stop-order controls

- Overnight rate competitiveness

- On-chart trading

- Trading rebates

- API access and platform support

Final Thoughts

Rating Formula 5.0 represents a significant leap forward in broker evaluation. It offers enhanced accuracy and specialization through adaptive weight modeling, providing traders with ratings that align more closely with their actual needs.

The ability to generate tailored rating profiles for different trading strategies and experience levels is a game-changer, making the system more relevant and insightful than any previous version.

Looking Ahead: The Future of Rating Systems

In an era increasingly plagued by fake reviews and misinformation, the need for transparent, data-driven evaluation frameworks has never been more critical. The rise of web bots, click farms, and deceptive marketing only amplifies this demand. As technology evolves, particularly through Blockchain and Artificial Intelligence, the future of rating systems lies in personalization and autonomy.

Web 3.0: Intelligent, Secure, and Personalized Ratings

With the rise of Web 3.0, users will gain access to fully personalized rating systems. Instead of relying on one-size-fits-all scores, users will:

-

Define their own evaluation criteria—or

-

Let the system learn from their behavior to automatically generate relevant ratings

These intelligent systems will leverage a combination of AI, machine learning, and blockchain to ensure ratings are not only personalized but also secure, private, and tamper-proof.

In this new digital landscape, search engines, rating platforms, and financial tools will need to evolve. Objective, reliable, and user-specific evaluations will become standard, enabling users to make informed decisions in a secure and trustworthy environment.

Concept and implementation by George M. Protonotarios, Financial Analyst –MSc in “International Banking & Finance”

All rights reserved (c) Qexpert.com (2022)

MORE: ► Financial Books | ► RSI Precision (enhanced RSI) | ► TCI System | ► PriceMomentum: New Chart Type