THE CAPITAL CYCLE

THE CAPITAL CYCLE

- Subtitle: Equity, Currency, Crypto, and Gold Market Cycles and Trends Since 1896

- Author: George M. Protonotarios

- Language: English

- Number of Pages: 161

Description:

The ‘Capital Cycle’ explores the trends and recurring patterns of the global economy and financial markets since 1896. The book seeks to uncover order amid economic chaos and structure within the apparent complexity of financial markets. While every investment carries a high degree of uncertainty, an educated bet remains far superior to a random walk.

🔗 Buy the PDF version on Payhip | 🔗 Buy the ePub version on Amazon

- TABLE OF CONTENTS -

This book aims to provide a comprehensive analysis of economic and international market cycles, emphasizing the duration of each. Understanding the average length and starting point of these cycles enables investors to estimate when they are likely to conclude. There are also important insights in seasonality statistics that may make you question the randomness of financial markets.

Chapter 1 explores the overall structure and duration of the typical economic/business cycle, referencing models such as Kondratiev’s Long Wave Theory and the Economic Confidence Model. It further examines the dynamics of interest rate fluctuations, the role of money supply, and market liquidity. Within this framework, the first chapter evaluates how financial markets respond to shifts in liquidity conditions. Finally, it explores crude oil cycles alongside seasonal trends.

Chapter 2 analyzes the structure of the stock market cycle, with particular attention to the role of seasonality and the duration of mid-term trends. It provides an in-depth analysis of historical cycles across major indices, including the Dow Jones, S&P 500, Nasdaq, and DAX. Additionally, the second chapter investigates the connection between corporate earnings and equity market cycles. Finally, it highlights key seasonal patterns identified through historical data.

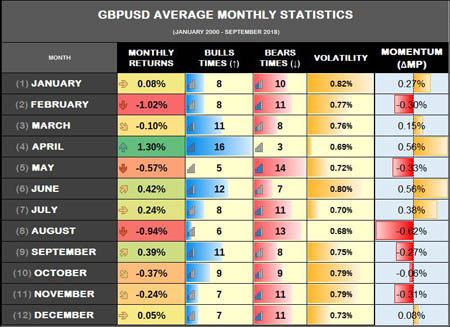

Chapter 3 explores cyclical patterns in the Foreign Exchange market, with a focus on key seasonal trends. Exchange rates fluctuate in accordance with the dynamics of international demand and supply, which, in turn, are influenced by macroeconomic data, sociopolitical factors, and the objectives of central banks. The third chapter examines the US Dollar Index and EURUSD macro cycles along with the seasonality analysis of eight Forex pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD, and EUR/GBP).

Chapter 4 focuses on cryptocurrencies and gold. As an emerging asset class, cryptocurrencies combine blockchain technology and cryptography to enable a decentralized and transparent financial ecosystem. The fourth chapter investigates the four-year cryptocurrency market cycle, with particular attention to the seasonal patterns of Bitcoin and Ethereum. Finally, the chapter examines the cyclical trends and seasonal trends in the gold market

Chapter 5 explores several well-established methods and analytical frameworks used in cyclical analysis. It provides in-depth coverage of the Dow Theory market cycle, the Elliott Wave Principle, Wyckoff’s Accumulation/Distribution model, and Gann’s cyclical theory. The fifth chapter concludes with an examination of Benner’s Cycle Model, first introduced in 1872.

Overview:

The Capital Cycle seeks to uncover order amid economic chaos and structure within the apparent complexity of financial markets. While every investment carries a high degree of uncertainty, an educated bet remains far superior to a random walk.

Historically, capital markets exhibit cyclicality, moving through the recurring phases of accumulation, growth, peaking, decline, and bottoming out. Each market cycle includes periods of sustained expansion and contraction that align with the broader stages of the business cycle. Equities tend to perform very well during the early and mid-growth phases of the business cycle and poorly during the final stage of recession

Summary of Key Findings

From 1945 to 2020, U.S. business cycles averaged 6.21 years, closely aligning with the Federal Funds Rate cycle of 6.58 years. Within each business cycle, equities experience mid-cycles. The Dow Jones Industrial Average’s average mid-cycle duration of 3.2 years suggests that roughly 2 major stock market trends unfold within each business cycle (2 × 3.2 = 6.4).

Beyond the business cycle, economies move through secular cycles spanning multiple decades, influenced by debt dynamics, political forces, and technological change. Historical troughs between 1932-1974 (42.5 years) and 1974-2009 (34.5 years) indicate an average secular duration of 38.5 years, equivalent to roughly six business cycles (6 × 6.21 = 37.26). These long economic waves correspond to major equity market bottoms in 1932, 1974, and 2009, confirming that stock market secular cycles mirror the secular rhythm of the economy.

The following figures represent the average macro-cycle durations across major asset classes:

- Dow Jones Industrial / S&P 500: 37.5-38.5 years

- Gold: 29.5 years

- NASDAQ / DAX: 28.0-28.5 years

- US Dollar Index: 15 years

- Cryptocurrencies: 4 years

The Capital Cycle is structured around five chapters:

- Chapter 1 outlines the business cycle and liquidity dynamics, examining economic models and relating interest rates, money supply, and oil price cycles to broader market trends.

- Chapter 2 explores stock market structure, mid-cycles, and seasonality across Dow Jones, S&P 500, NASDAQ, and DAX, linking corporate earnings with equity performance.

- Chapter 3 examines the Foreign Exchange market, analyzing the macro and seasonal cycles of the US Dollar Index and eight pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD, EUR/GBP), emphasizing how central bank policies influence exchange rates.

- Chapter 4 focuses on cryptocurrencies and gold, tracing Bitcoin and Ethereum’s four-year cycles alongside gold’s long-term and seasonal patterns.

- Chapter 5 presents the analytical framework of key cyclical theories (Dow Theory, Elliott Waves, Wyckoff’s Method, Gann’s Cycles, and Benner’s Model) -each offering a distinct perspective on market rhythm and investor psychology.

🔗 Buy the PDF version on Payhip | 🔗 Buy the ePub version on Amazon

■ The Capital Cycle (English)

George M. Protonotarios (2025) ©-All rights reserved

Qexpert.com

🔗 MORE BOOKS: ► Think Like a Whale Trade as a Shark | ► Patterns Behind 15 Forex Pairs | ► Phi and the Fibonacci Numbers | ► Cryptocurrency Trading Analysis | ► Bitcoin & Ethereum Trader