A GAME OF CHESS ON THE GLOBAL MARKETS (GREEK)

A GAME OF CHESS ON THE GLOBAL MARKETS (GREEK)

Subtitle: Investing in Equities, Forex Currencies, and Cryptocurrencies Using Technical and Fundamental Analysis

Subtitle: Investing in Equities, Forex Currencies, and Cryptocurrencies Using Technical and Fundamental Analysis- Author: George M. Protonotarios

- Language: Greek

- Number of Pages: 250

Description:

This is my first book written in Greek, covering the most important principles of technical and fundamental analysis. It also includes insights into identifying investment risks and managing portfolios.

► Buy the PDF version on Payhip | ► Buy the ePub version on Kobo

- TABLE OF CONTENTS -

Table of Contents:

-

The Role and Influence of Institutional Investors

-

Researching the Master Trend

-

Identifying Chart Patterns

-

Critical Numbers and Fibonacci Tools

-

Wyckoff's Method and Formations

-

The Use of Moving Averages

-

Volume Analysis and Key Ratios

-

MACD and RSI Technical Indicators

-

Interest Rates and the Macroeconomic Environment

-

Fundamental Analysis of Three Major Markets

-

Investment Risk Analysis

-

Portfolio Management and Key Ratios

Overview:

-

Chapter 1 discusses the influence of institutional investors in global markets. It covers tools like the COT analysis and volatility indices (VIX and SKEW), which are often used to gauge market psychology and structure.

-

Chapter 2 introduces chart analysis methods and how to identify dominant price trends, including fundamental assumptions of technical analysis and key chart types.

-

Chapter 3 presents the most important price patterns in charts, such as candlestick formations, chart patterns, and Elliott Wave theory.

-

Chapter 4 focuses on the Fibonacci sequence and tools like Fibonacci Retracement and Extensions. It also introduces a new harmonic sequence combining prime numbers and Fibonacci.

-

Chapter 5 explains Richard Wyckoff's method, covering market phases and the accumulation/distribution chart.

-

Chapter 6 covers moving averages (MAs), focusing on those that provide key support or resistance signals in market trends.

-

Chapter 7 explores the role of trading volume in chart analysis, introducing the VPVR indicator, which helps identify critical support and resistance levels.

-

Chapter 8 explains the MACD and RSI indicators. MACD is useful for long-term trends, while RSI helps identify overbought or oversold conditions. A version of RSI called "RSI Precision" is also included.

-

Chapter 9 examines the role of interest rates in the economy and investments, introducing the basics of fundamental analysis and how to predict interest rate movements.

-

Chapter 10 delves into the fundamental analysis of three key markets: equities, Forex, and cryptocurrencies.

-

Chapter 11 analyzes investment risks, including systematic and unsystematic risks, and explains how portfolio diversification can reduce risk.

-

Chapter 12 covers portfolio management and the key metrics used to evaluate performance and risk, including correlations between markets.

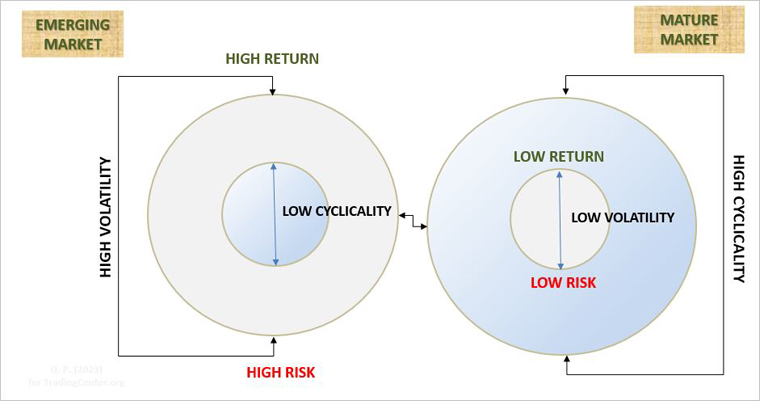

Market Diversification: Mature vs. Emerging Markets

The book also looks at the differences between mature and emerging markets, focusing on volatility and market cycles. As shown in the chart, mature markets:

-

Follow longer cycles

-

Are less volatile

-

Offer lower risk/return ratios compared to emerging markets

Chart: Comparing mature and emerging markets

► Buy the PDF version on Payhip | ► Buy the ePub version on Kobo

■ A Game of Chess on the Global Markets Book (Greek)

George M. Protonotarios (2021) ©-All rights reserved

Qexpert.com

MORE BOOKS: ► Think Like a Whale Trade as a Shark | ► Patterns Behind 15 Forex Pairs | ► Phi and the Fibonacci Numbers | ► Cryptocurrency Trading Analysis | ► Bitcoin & Ethereum Trader