BITCOIN & ETHEREUM TRADER

BITCOIN & ETHEREUM TRADER

-

Subtitle: Combining Fundamentals, Technical Analysis, and Market Sentiment to Trade Forex, Equities, and Cryptocurrencies

-

Author: George M. Protonotarios

-

Number of Pages: 132

Description:

Bitcoin & Ethereum Trader is an in-depth guide that equips traders with the knowledge needed to navigate the rapidly evolving world of cryptocurrency trading. This book combines technical analysis, market sentiment, and on-chain data, focusing specifically on the two leading cryptocurrencies: Bitcoin and Ethereum.

The Future of Cryptocurrency

The cryptocurrency market has dramatically reshaped traditional finance, presenting unique opportunities for savvy investors. Its decentralized nature and continuous innovation have paved the way for a new asset class. While the future of cryptocurrencies is uncertain, Bitcoin and Ethereum stand out due to their adoption rates and the strength of their network effects. Both blockchain protocols offer the highest chances of long-term success, making them essential assets for any crypto trader’s portfolio.

► Buy it on Amazon (ePub) ► Buy the PDF version on Payhip

- TABLE OF CONTENTS -

This book covers everything you need to successfully trade Bitcoin and Ethereum. It blends technical analysis with on-chain data, market sentiment, and the fundamentals that drive these cryptocurrencies.

Chapters Include:

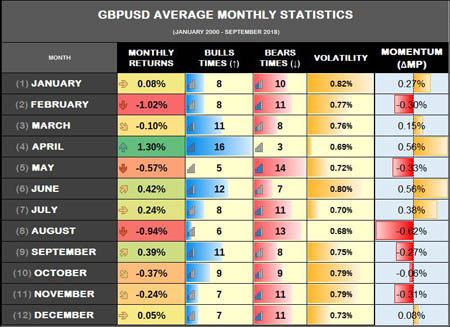

Chapter 1: The Crypto Market Cycle & Seasonality

This chapter explores the cyclical nature of the crypto market, which follows a four-year cycle. It highlights seasonal patterns, showing that Bitcoin tends to perform exceptionally well in Q4, while Ethereum shines in the first half of the year.

Chapter 2: Following the Trend

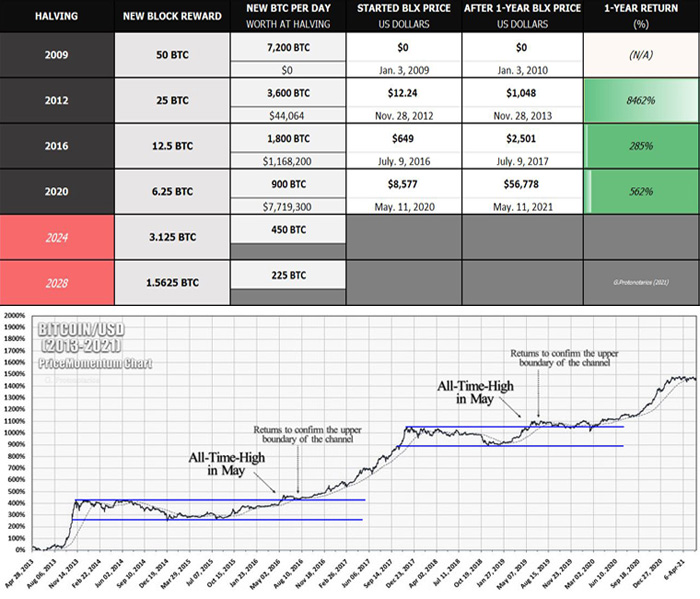

Learn how to identify the prevailing market trend using a variety of tools, including a newly introduced chart type called PriceMomentum. This tool combines price momentum and periodic volatility to offer insights into volatile markets.

Chapter 3: Buying the Dips & Selling the Tops

Master the art of spotting market tops and bottoms early. This chapter introduces new methods, such as the use of RSI Precision and MACD signals, as well as Wyckoff Schematics, to identify key reversal points in the market.

Chapter 4: On-Chain Analysis

Dive into the power of on-chain data and its ability to predict market movements. Learn about key indicators like the Puell Multiple, NVT, and Unrealized Profit/Loss that help traders identify market tops and bottoms.

Chapter 5: The Impact of Crypto Derivatives

Understand the role of derivative products in the cryptocurrency market. Learn about Open Interest and Commitments of Traders reports, as well as how to interpret premiums and discounts in Bitcoin Futures.

Chapter 6: The Role of Bitcoin Dominance

Bitcoin dominance plays a crucial role in the broader cryptocurrency market cycle. This chapter explores how Bitcoin often leads market rallies and dominates early in each bull market cycle. While history may not repeat itself, understanding these patterns can help you time your investments more effectively.

Image: Bitcoin Halving and the PriceMomentum chart

Chapter 7: Trading Against Retail Sentiment

Here, you’ll learn to distinguish between expert sentiment—which is generally worth following—and retail sentiment, which is often contrary to profitable trading decisions. Learn how indicators like the Fear & Greed Index and crypto funding rates reveal the market's overbought and oversold conditions.

Chapter 8: The Correlation to Traditional Markets

Explore the relationship between cryptocurrencies and traditional markets like equities, gold, and the US dollar. Liquidity in global financial markets flows like water in communicating vessels, affecting each asset class differently. This chapter helps you understand how cryptocurrency correlates with these traditional assets.

► Buy it on Amazon (ePub) ► Buy the PDF version on Payhip

George M. Protonotarios (2021) ©-All rights reserved

Qexpert.com

MORE BOOKS: ► Think Like a Whale Trade as a Shark | ► Patterns Behind 15 Forex Pairs | ► Phi and the Fibonacci Numbers | ► Cryptocurrency Trading Analysis