THE CAPITAL CYCLE

THE CAPITAL CYCLE

- Subtitle: Equity, Currency, Crypto, and Gold Market Cycles and Trends Since 1896

- Author: George M. Protonotarios

- Language: English

- Number of Pages: 161

Description:

The ‘Capital Cycle’ explores the trends and recurring patterns of the global economy and financial markets since 1896. The book seeks to uncover order amid economic chaos and structure within the apparent complexity of financial markets. While every investment carries a high degree of uncertainty, an educated bet remains far superior to a random walk.

🔗 Buy the PDF version on Payhip | 🔗 Buy the ePub version on Amazon

- TABLE OF CONTENTS -

This book aims to provide a comprehensive analysis of economic and international market cycles, emphasizing the duration of each. Understanding the average length and starting point of these cycles enables investors to estimate when they are likely to conclude. There are also important insights in seasonality statistics that may make you question the randomness of financial markets.

THINK LIKE A WHALE TRADE AS A SHARK

-

Subtitle: Combining Fundamentals, Technical Analysis, and Market Sentiment to Trade Forex, Equities, and Cryptocurrencies

-

Author: George M. Protonotarios

-

Number of Pages: 146

Description:

This book contains everything you need to know to trade equities, Forex, and cryptocurrencies. It consolidates the essential skills required for trading across these markets, with a focus on the 60% of skills common to all financial assets. Whether you are a beginner or an experienced trader, you’ll find practical insights that will help you navigate these diverse markets effectively.

To succeed in any financial market, three key conditions must be met:

-

A strong fundamental landscape

-

A solid market structure

-

An accurately measured trading range

When the fundamentals align and the market structure is proven, the only thing left to determine is the trading range. This book introduces a wide variety of technical analysis techniques to help investors identify market structure early, pinpoint support and resistance levels, and measure the trading range with precision.

However, financial trading is a zero-sum game—for every winner, there’s a loser. While some traders make significant profits, many others continuously lose. This is why successful investors often adopt a contrarian approach, trading against the prevailing market sentiment to find the best opportunities.

► Find the eBook on Amazon (ePub) | ► The PDF version on Payhip

BITCOIN & ETHEREUM TRADER

BITCOIN & ETHEREUM TRADER

-

Subtitle: Combining Fundamentals, Technical Analysis, and Market Sentiment to Trade Forex, Equities, and Cryptocurrencies

-

Author: George M. Protonotarios

-

Number of Pages: 132

Description:

Bitcoin & Ethereum Trader is an in-depth guide that equips traders with the knowledge needed to navigate the rapidly evolving world of cryptocurrency trading. This book combines technical analysis, market sentiment, and on-chain data, focusing specifically on the two leading cryptocurrencies: Bitcoin and Ethereum.

The Future of Cryptocurrency

The cryptocurrency market has dramatically reshaped traditional finance, presenting unique opportunities for savvy investors. Its decentralized nature and continuous innovation have paved the way for a new asset class. While the future of cryptocurrencies is uncertain, Bitcoin and Ethereum stand out due to their adoption rates and the strength of their network effects. Both blockchain protocols offer the highest chances of long-term success, making them essential assets for any crypto trader’s portfolio.

CRYPTO TRADING GUIDE

CRYPTO TRADING GUIDE

-

Subtitle: Fundamental & Technical Analysis for Cryptocurrency Thinkers

-

Author: George M. Protonotarios

-

Number of Pages: 115

Description:

Just a decade ago, the idea of issuing, exchanging, and using digital money without the control of a centralized bank seemed like a distant dream. Yet, with the rapid global expansion of the internet, that dream became a reality far sooner than expected. Technological innovation, especially when it meets the emerging needs of society, spreads faster than ever before—and cryptocurrencies are a prime example. By enabling fast, low-cost, and secure global transactions, cryptocurrencies—powered by blockchain—are transforming finance with their scalability and programmability.

This book is a comprehensive guide to cryptocurrency trading, designed for both beginners and experienced traders. It offers valuable insights into the crypto ecosystem, covering fundamental and technical analysis, trading strategies, and risk management. Whether you're just starting or looking to refine your skills, this guide aims to turn readers into cryptocurrency thinkers.

► Find the eBook on Amazon (ePub) | ► PDF Version on Payhip

Read more: Fundamental and Technical Analysis for Cryptocurrency Thinkers Book

A GAME OF CHESS ON THE GLOBAL MARKETS (GREEK)

A GAME OF CHESS ON THE GLOBAL MARKETS (GREEK)

Subtitle: Investing in Equities, Forex Currencies, and Cryptocurrencies Using Technical and Fundamental Analysis

Subtitle: Investing in Equities, Forex Currencies, and Cryptocurrencies Using Technical and Fundamental Analysis- Author: George M. Protonotarios

- Language: Greek

- Number of Pages: 250

Description:

This is my first book written in Greek, covering the most important principles of technical and fundamental analysis. It also includes insights into identifying investment risks and managing portfolios.

► Buy the PDF version on Payhip | ► Buy the ePub version on Kobo

- TABLE OF CONTENTS -

Table of Contents:

-

The Role and Influence of Institutional Investors

-

Researching the Master Trend

-

Identifying Chart Patterns

-

Critical Numbers and Fibonacci Tools

-

Wyckoff's Method and Formations

-

The Use of Moving Averages

-

Volume Analysis and Key Ratios

-

MACD and RSI Technical Indicators

-

Interest Rates and the Macroeconomic Environment

-

Fundamental Analysis of Three Major Markets

-

Investment Risk Analysis

-

Portfolio Management and Key Ratios

THE HIDDEN PATTERNS BEHIND 15 FOREX PAIRS

THE HIDDEN PATTERNS BEHIND 15 FOREX PAIRS

- Subtitle: Revealing Momentum and Seasonal Patterns Based on 18.5 Years of Daily Exchange Rates

- Author: George M. Protonotarios

- Number of Pages: 150

Description:

Fundamental analysis and statistics together form a powerful framework for studying the behavior of global financial markets. While fundamental analysis explores the causes of macroeconomic events, statistical and technical analysis reveal their effects on price movements.

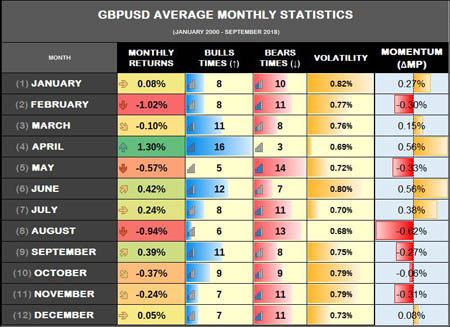

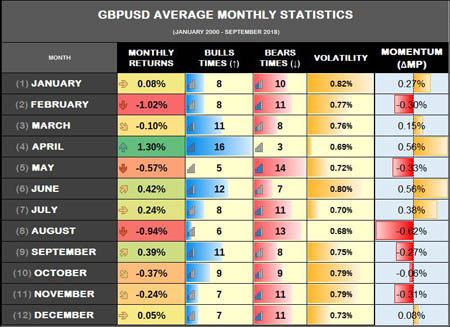

This book delves into the statistical side of Forex trading—examining 18.5 years of daily data to uncover recurring seasonal and momentum-based patterns in 15 major currency pairs. Due to the structure of the global monetary system, currencies often follow seasonal trends shaped by recurring economic cycles and institutional behavior. Certain months or periods tend to produce specific patterns as major market participants take similar actions year after year.

The 15 Forex pairs analyzed include:

- EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NZDUSD, EURGBP, EURCHF, EURJPY, EURCAD, EURAUD, EURNZD, GBPJPY, and GBPCHF.

Through extensive historical analysis, a unique momentum indicator—ΔMP (Delta Momentum Pattern)—is introduced. This proprietary indicator captures the historical divergence between closing prices and intraday ranges, offering a quantifiable view of momentum strength. Each currency pair is analyzed using ΔMP charts, enhanced with linear and polynomial trendlines, along with R-squared (R²) values to measure statistical reliability.

► Find the eBook on Amazon (ePub) | ► The PDF version on Payhip